In 2025, e-wallets are more than just payment tools—they’re digital lifelines. From peer-to-peer transfers and online shopping to in-store QR payments and crypto wallets, users demand convenience, trust, and frictionless experiences.

This makes e-wallet UI/UX design a critical factor in product adoption, retention, and security. In this in-depth guide, Viartisan explores how to design e-wallet apps that are not only secure and functional but also delightful and brand-differentiated.

Why UI/UX Design Matters in e-Wallets

E-wallets deal with one of the most sensitive areas of user interaction—money. Unlike entertainment or retail apps, mistakes or confusion in wallet design can cost real value, reputation, and trust.

Top UX Challenges in e-Wallets

- Real-time expectations: Users want instant responses and confirmations.

- Security transparency: Clear UX is needed to show users their data and funds are protected.

- Context-sensitive design: Users may access their wallets in public, at night, on poor networks—design must adapt.

A great e-wallet experience blends:

- Fast and accessible interaction design

- High-level security cues with minimal intrusion

- Cross-platform consistency for mobile, web, and wearable devices

Core UX Principles for e-Wallet Design

1. Frictionless Onboarding

Onboarding can be a drop-off point in fintech apps. Your design should:

- Minimize form fields using OCR or ID scan features

- Integrate biometric sign-up & login for quick access

- Show a progress bar during multi-step verification

Example: Onfido offers a seamless identity verification API for fintech UX flows.

2. Transparent Money Movement

Clear labeling and iconography reduce mistakes and hesitation:

- Use simple verbs (Send, Receive, Add, Withdraw)

- Show recipient preview, transfer limits, and estimated fees upfront

- Add visual feedback after each action: animation, success banner, or vibration

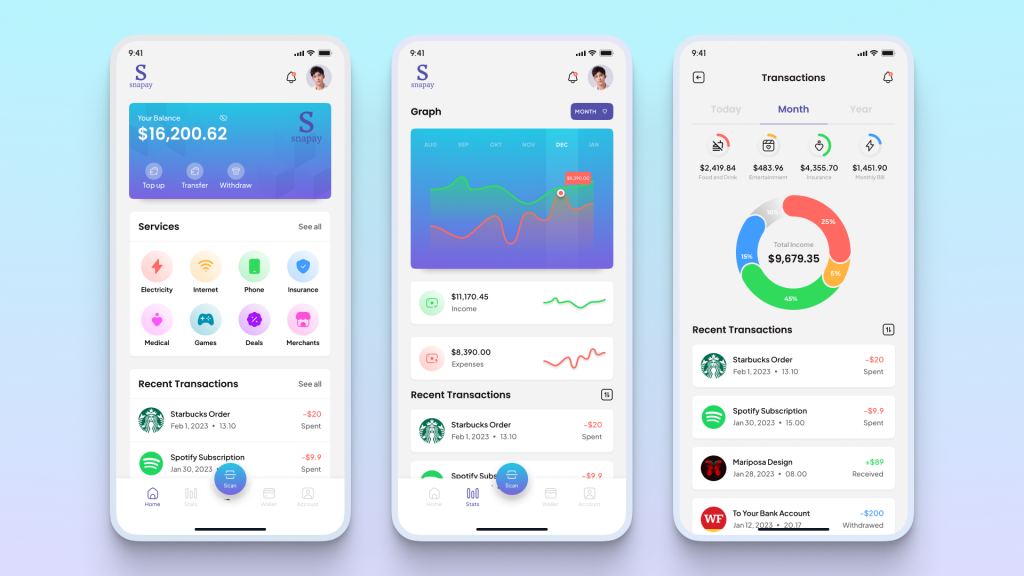

3. Personalization & Dashboard UX

Wallets should feel personal and purposeful:

- Allow custom nicknames for cards or bank accounts

- Show dynamic visualizations of spending, balance, trends

- Integrate goals (saving for travel, paying down debt) with progress bars

UI Design Best Practices for Digital Wallets

Effective Visual Hierarchy

- Emphasize available balance, then actions (Send, Scan, Pay)

- Design with card-like UI modules (e.g., for bank accounts or loyalty)

- Use contrast and icons to reduce reliance on reading—especially in low-light or fast-use scenarios

Transaction UX Flows

- Support drag-and-drop actions for repeat payments

- Use visual recipient avatars for peer-to-peer (P2P) comfort

- Offer real-time validation of card/account numbers (e.g., BIN matching)

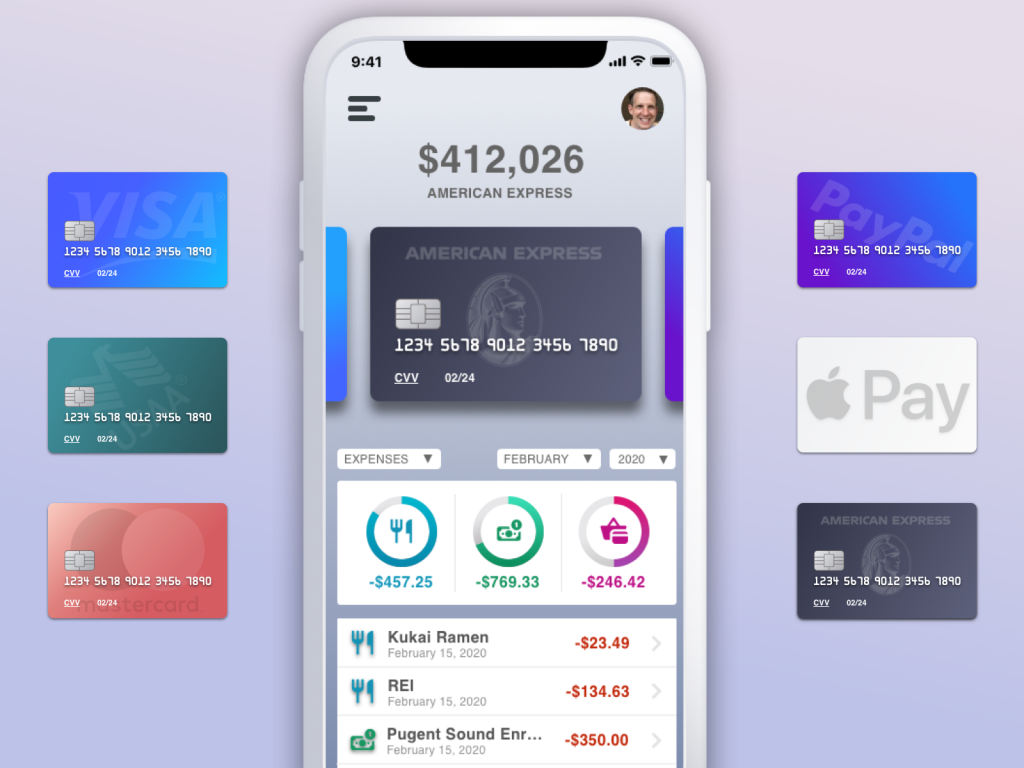

Payment Sources & Cards Management

- Let users freeze/unfreeze cards from the UI

- Display virtual card CVV with biometric unlock

- Group cards by color or function (primary, joint, crypto, business)

Recommended Read: Frictionless Fintech UX Principles

Security-Centric UX

Security is only useful if users trust and understand it. Clarity beats complexity.

What Good Security UX Includes

- Immediate alert for any new device login or location

- Notification center with categorized actions (e.g., flag transaction, change PIN)

- Explainers: a short tooltip on “Why we need your ID selfie”

Suggested Tools: Cognito or Auth0 for frictionless login with compliance

Accessibility and Multilingual UX

Inclusive Design Moves

- Support RTL languages (Arabic, Hebrew) and locale formatting for currencies

- Provide guided audio mode for visually impaired users

- Use haptic alerts in tandem with error states

Explore more: W3C Accessibility Standards

Localization Done Right

- Show currency format based on user location

- Use local payment methods (GCash in PH, iDEAL in NL, M-Pesa in Africa)

- Customize color symbolism—red may imply danger in the West but prosperity in China

Future-Focused UX Trends in e-Wallets

1. Smart Spending Alerts

- Contextual nudges (“You’ve spent 25% more on food this month”)

- Voice summary of monthly financial status

2. Crypto & DeFi Wallet UX

- Simplify seed phrase handling: gamified backup steps, cloud-encrypted storage

- Clarify gas fees or slippage in plain language

- Show NFT collections in wallet visually

3. Cross-Device Wallet Continuity

- Start a transaction on mobile, complete on smart watch

- Tap-to-pay visual consistency across platforms

External Insight: Finextra Report on Fintech UX 2024–2025

Real-World Examples: Learning from Leaders

Paytm (India)

Paytm is one of the most widely used digital wallets in India, serving hundreds of millions of users. Its UI/UX success lies in delivering a multipurpose experience under a single app architecture. Whether you’re topping up your mobile phone, transferring money via UPI, purchasing gold, or paying utility bills, the flow feels unified and effortless.

- Multi-service design: Users can move between wallet, bank account, and investment features without changing UI logic or context.

- Localized suggestions: The app uses real-time location data to suggest nearby stores, available cashbacks, or recharge offers.

- Gamification & loyalty: Cashback coupons and scratch cards are presented with playful animations, increasing engagement.

- Security indicators: Padlocks, “verified merchant” tags, and SMS confirmations reinforce trust.

Paytm’s strength lies in combining scale with contextual simplicity.

Apple Wallet

Apple Wallet exemplifies the art of minimalist design applied to financial interaction. Rather than adding new layers, Apple strips things down to their essentials—resulting in a clean, predictable experience.

- One-glance UX: Users instantly see their default card, tickets, or boarding passes without navigating tabs.

- WatchOS integration: Payments on Apple Watch mirror the visual flow of iOS, with vibration and color cues for success.

- Privacy-focused visuals: Apple uses subtle shading and blur effects to mask sensitive data until biometric authenticated.

- Seamless backups: Wallet items are tied to the iCloud ecosystem, making cross-device continuity feel effortless.

Apple Wallet’s design is not only polished but incredibly secure—delivering confidence without clutter.

ZaloPay (Vietnam)

ZaloPay builds on the social chat foundation of Zalo—Vietnam’s leading messaging app—to create a highly intuitive and local-first wallet experience.

- Fast onboarding in local language: New users complete setup in under 60 seconds, with native Vietnamese UI and SMS OTP authentication.

- QR-first design: Given Vietnam’s high QR code adoption, the app prioritizes Scan & Pay with floating buttons and camera-ready state.

- Chat-to-pay integration: Within Zalo Messenger, users can send/receive money directly in chats, similar to WeChat Pay.

- Mini-program ecosystem: Users can pay bills, shop, or order food within ZaloPay through lightweight embedded apps.

ZaloPay’s experience demonstrates how tightly integrated UI/UX and cultural behavior can elevate usage frequency and loyalty.

Final Thoughts

Building a successful e-wallet means balancing trust, performance, and usability. It must be lightning-fast, visually intuitive, inclusive, and 100% secure—all at once.

At Viartisan, we help fintech brands build human-centered digital wallets that users love and return to. Our designs are rooted in data, shaped by behavior, and built to scale.

📩 Talk to us about launching your next-gen wallet experienc